Canadian Softwood Lumber Capacity Is Not Sustainable

Canadian Softwood Lumber Capacity Is Not Sustainable

While some observers of the U.S. and Canadian softwood lumber (“SWL”) industries have claimed that the United States needs Canadian lumber, the truth is the opposite: the Canadian SWL industry needs the U.S. market. Canada’s focus on maintaining its U.S. market share at any cost is stunting the growth of the U.S. softwood lumber industry, which has the short-term capability to expand its production by over 17 percent if the effects of Canadian dumping practices are removed from the U.S. market.[1]

The Excess Capacity of Canadian Softwood Lumber Is Huge and Unsustainable

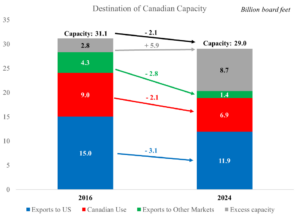

The Canadian SWL industry had 8.7 billion board feet (BBF) of excess capacity in 2024.[2] For context, consider that Canada’s excess capacity in 2024:

- Has tripled since 2016.

- Was 22 percent greater than the entire Canadian SWL market.

- Was the equivalent of 17 percent of U.S. consumption.

- Exceeded the capacity of any U.S. state. Canada’s excess capacity was 37 percent greater than the actual capacity of Oregon, the state with the largest SWL production.

The decline in demand for Canadian SWL is not only – or even primarily – a result of the U.S. AD/CVD orders on imports from Canada. In fact, since the orders were imposed, Canada’s shipments to non-U.S. markets declined by more than its exports to the United States. Canada’s shipments to its home market declined by 2.1 BBF, a decline of 23 percent. Canada’s exports to countries other than the United States declined by 2.8 BBF, a 66 percent decline. For example, Canada’s exports to China have declined by nearly two BBF since 2016, a decline of 78 percent. Thus, Canada has become even more reliant on the U.S. market than it was in 2016, and its excess capacity has more than tripled from 2.8 BBF to 8.7 BBF.

Canada’s excess capacity is also caused by issues on the supply side. Canadian producers are increasingly uncompetitive on costs, especially in British Columbia, where the availability of “economic” fiber supply declined by 42 percent from 2018 to 2023, according to the B.C. Council of Forest Industries.

These demand and supply side issues have contributed to an 8.0 BBF decline in Canadian production since 2016. However, the Canadian industry has reduced capacity by only 2.1 BBF since 2016, or only one quarter of the decline in production. Instead of reducing their uneconomic capacity further, major Canadian producers Canfor and West Fraser, by their own admission and data, have sold SWL to the U.S. market at prices below their cost of production. The high volume of low-priced Canadian softwood lumber imports has depressed lumber prices in the United States, forcing many domestic mills to close or curtail their production in recent years. According to FEA, 19 U.S. mills curtailed production, 2.7 billion board feet of capacity closed altogether, and U.S. capacity utilization averaged 80 percent during 2023-24,[3] while large volumes of Canadian lumber entered the U.S. market at prices that cause large financial losses at Canadian firms.

The U.S. Softwood Lumber Industry Would be Producing More If Not Hamstrung by Canada

The respected Western Wood Products Association estimates that the capacity utilization of the U.S. softwood lumber industry was 78 percent in 2024. At a 91 percent utilization rate, which has been achieved by both the Canadian and U.S. industries in the past, the U.S. industry could have supplied an additional 6.1 BBF of lumber to the U.S. market. But the domestic industry could not even come close to this utilization rate when competing with the 11.9 BBF of Canadian softwood lumber imports being sold in the United States at dumped prices causing huge losses in Canada.

Based on these data, and the competitive circumstances in bilateral lumber trade, the notion that the U.S. market needs Canadian lumber is belied by the facts. The real issue is that U.S. producers of softwood lumber are producing much less because Canadian producers would rather dump their softwood lumber into the U.S. market at a loss instead of right-sizing their industry to fit market constraints. With small and relatively weak home and non-U.S. international markets, it appears that Canadian softwood lumber producers need the U.S. market much more than the U.S. market needs Canadian lumber. And with the right trade policies moving forward, the U.S. industry has the capability to continue its growth trajectory to achieve the President’s goal of complete self-sufficiency.

Data Sources: Western Wood Products Association (WWPA), Forest Economic Advisors (FEA), and Global Trade Atlas.

[1] The calculation is based on domestic production at 91% of the practical capacity reported by the Western Wood Products Association.

[2] The Canadian SWL industry operated at a utilization rate of 70 percent in 2024. Canadian capacity was 29.0 BBF but produced only 20.3 BBF, resulting in 8.7 BBF of excess capacity.

[3] Curtailments and closures are based on FEA’s 2024Q4 mill database. U.S. practical capacity utilization for 2023 (80%) and 2024 (78%) are reported in Western Wood Products Association’s December 2024 issue of Lumber Track.