U.S. Lumber Coalition and American Loggers Council Disappointed by CNBC Inaccurate Reporting on U.S. Softwood Lumber Cost, Import Duties and Housing Affordability

CONTACT:

Zoltan van Heyningen

[email protected] | 202-805-9133

Scott Dane

(202) 627-6961

U.S. Lumber Coalition and American Loggers Council Disappointed by CNBC Inaccurate Reporting on U.S. Softwood Lumber Cost, Import Duties and Housing Affordability

- Assertions that lumber price volatility and import duties on lumber are pricing consumers out of the market are false.

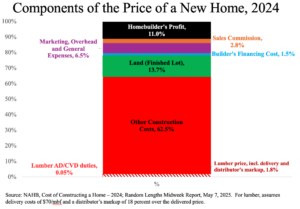

- Lumber accounts for a very small share of the sales price of a newly constructed home, typically 1-2 percent.

- Enforcing the U.S. trade laws helps ensure that there is a healthy and growing supply of domestically produced lumber to build American homes, all without impacting the cost of a new home

Washington, D.C., May 22, 2025 – “The coverage by CNBC entitled ‘Why The U.S. Might Increase Duties On Canadian Lumber Again’ is disappointingly one-sided reporting from a business news network. The claims made in the piece asserting that lumber price volatility and import duties on lumber are pricing consumers out of the market are false,” stated Andrew Miller, Chair/Owner of Stimson Lumber Company and Chairman of the U.S. Lumber Coalition.

The CNBC reporting included views of Canadian analysts and U.S. homebuilding representatives but, crucially, did not include input from U.S. lumber producers nor U.S. loggers who are supplying the vast majority and growing share of the softwood lumber needed to satisfy U.S. home building demand.

“Lumber accounts for a very small share of the sales price of a newly constructed home, typically 1-2 percent. Lumber prices are currently low by historical standards and have not kept pace with inflation. So the idea that import duties on a fraction of the cost of new home is pricing buyers out of the market as reported by CNBC is nonsensical,” stated Mr. Miller, adding that “the focus should be on the devastating Canadian unfair trade practices that are continuing to harm the stability of the U.S. softwood lumber supply.”

“The enforcement of the U.S. trade laws against Canada’s unfair trade practices has been an incredible success, adding over 8.7 billion board feet of U.S. lumber capacity and the production of over 30 billion board feet of lumber cumulatively since 2016 – enough to build two million U.S. homes,” added Miller.

“For decades I have watched railcar after railcar transit south daily through Minnesota loaded with Canadian lumber, only to return empty. The U.S. can produce more lumber domestically and loggers are prepared to provide the additional timber to make that lumber, while at the same time improving the health of U.S. forests,” said Scott Dane, Executive Director of the American Loggers Council.

And the U.S. industry has room to grow. For seven of the last nine years, U.S. capacity growth exceeded the growth in U.S. consumption. There are certainly sufficient timber resources to supply U.S. demand for softwood lumber. In the U.S. South, harvestable forest growth exceeds harvest volumes by 40 percent. Access to harvestable timberlands is not a binding constraint on U.S. lumber capacity as a whole. The U.S. Forest Service confirms that across the United States, average annual net growth continues to exceed removals.

While lumber is a small share of house’s cost, in general, lumber has made an even smaller contribution to the increase in house prices that has occurred in recent years. From 2015 to 2024, the average sales price of a new home increased by $157,214 while the cost of the lumber in a typical home increased by $901 per house. Thus, the increase in lumber prices was the equivalent of 0.57 percent of the increase in U.S. home prices over the past decade.

By contrast, since 2019, the net income margin of the five largest homebuilder companies expanded profit margins by 49 percent. An index of stock prices for the 16 largest publicly traded companies more than doubled from 2019 to 2024. While homebuilder stock prices have declined to some extent in the spring of 2025, they remain at elevated levels.

“Commodities other than lumber have seen much larger price increases, including building materials such as iron & steel and cement & concrete,” stated Zoltan van Heyningen, Executive Director of the U.S. Lumber Coalition.

“One must look elsewhere for a solution to new home prices — land, labor, regulatory restrictions, and the free market reality of homebuilding demand has boosted many homebuilding input prices. Simply put, it is not credible to blame softwood lumber for increases in U.S. house prices,” added van Heyningen.

“We support President Trump’s plan to further increase the supply of Made in the U.S.A. softwood lumber to build U.S. homes,” concluded Miller.

Enforcing the U.S. trade laws helps increase the U.S. supply of lumber to build American homes, all without impacting the cost of a new home, as demonstrated by data from the National Association of Home Builders (NAHB) and Fastmarkets Random Lengths.

About the U.S. Lumber Coalition

The U.S. Lumber Coalition is an alliance of large and small softwood lumber producers from around the country, joined by their employees and woodland owners, working to address Canada’s unfair lumber trade practices. Our goal is to serve as the voice of the American lumber community and effectively address Canada’s unfair softwood lumber trade practices. The Coalition supports the full enforcement of the U.S. trade laws to allow the U.S. industry to invest and grow to its natural size without being impaired by unfairly traded imports. Continued full enforcement of the U.S. trade laws will strengthen domestic supply lines by maximizing long-term domestic production and lumber availability produced by U.S. workers to build U.S. homes. For more information, please visit the Coalition’s website at www.uslumbercoalition.org.

About the American Loggers Council

The American Loggers Council is dedicated to supporting the logging industry by advocating for fair opportunities for loggers and providing reliable information about the sector. We unite independent loggers and log truck contractors across the nation, working to improve their rights and promote sustainable forestry practices. American Wood from American Woods. For more information, please visit the American Loggers Council’s website at www.americanloggerscouncil.com.