Featured Resource

How Duties are Determined and Implemented

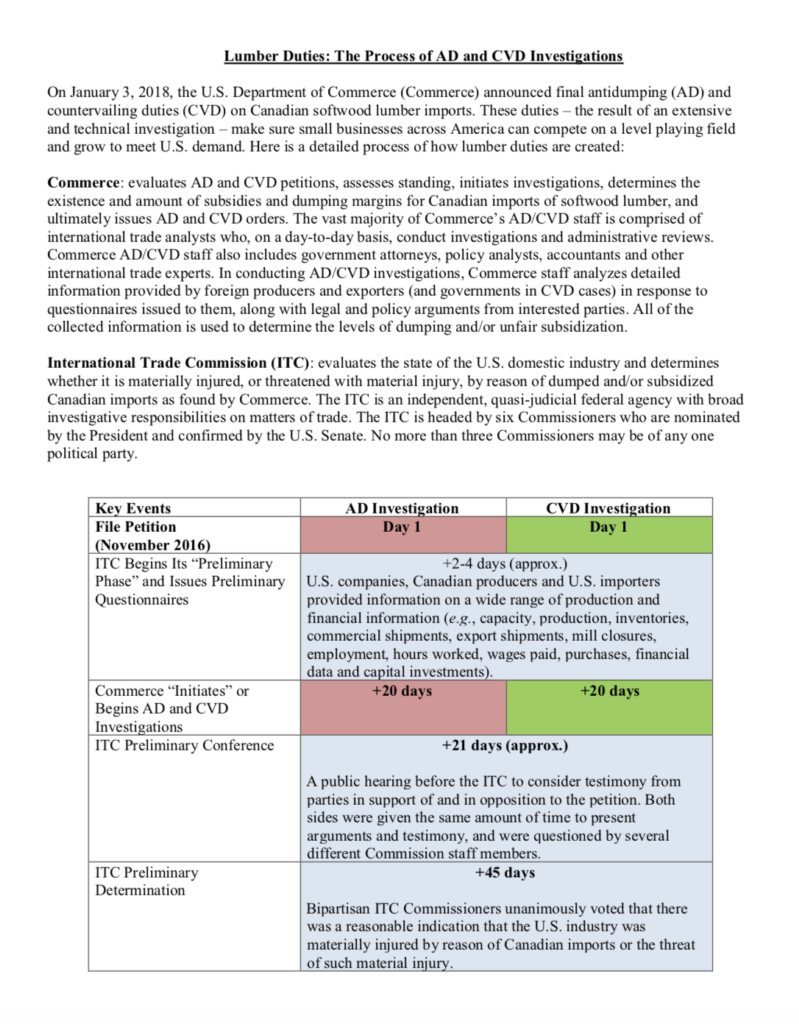

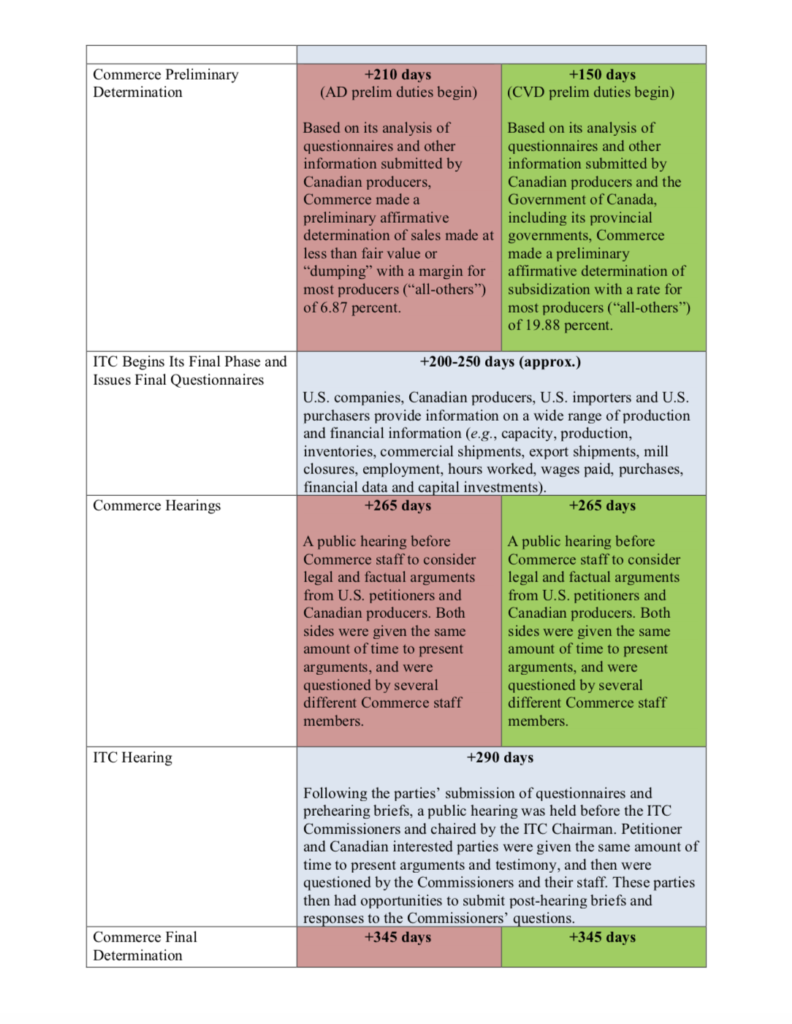

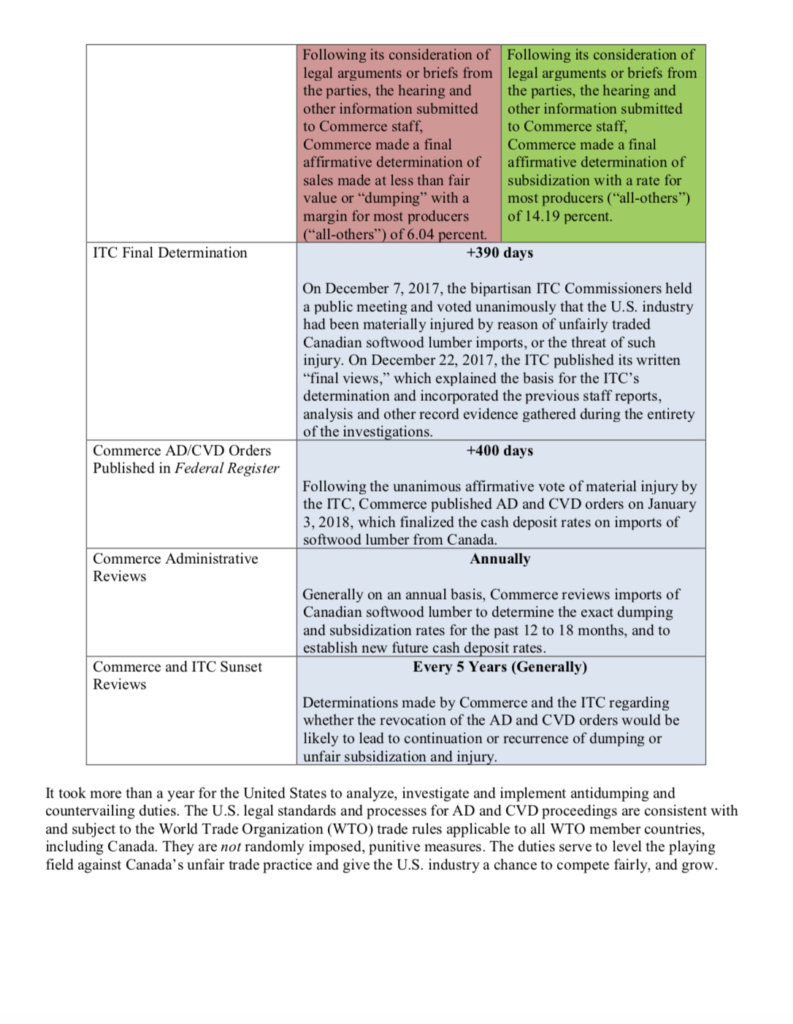

On January 3, 2018, the U.S. Department of Commerce (Commerce) set final antidumping and countervailing duties on Canadian softwood lumber imports after more than a year and a half long investigation in conjunction with the U.S. International Trade Commission (ITC). How did this decision come about?

Unlike some tariffs and trade measures that are imposed as a punitive measure, these duties are a result of an extensive, in-depth technical investigation that usually lasts for more than a year. During this time, Commerce and the ITC gather input and data from American businesses, local communities, foreign governments and foreign producers. These agencies conduct multiple public hearings and analyze extensive economic and trade data before making their findings. These findings may be subject to further appellate review before U.S. courts, NAFTA panels and WTO panels.

These duties stand above politics and go beyond party lines. They are not random: they are the result of rigorous economic and trade analysis and bipartisan review.

These duties are essential to facilitate free and fair trade, giving businesses a shot to compete on a level playing field.

Below is a look at the thorough, rigorous and technical process it takes to impose antidumping and countervailing duties.