High Homebuilder Profits Have Priced Millions Out of the U.S. Housing Market

High Homebuilder Profits Have Priced Millions Out of the U.S. Housing Market

Based on the National Association of Homebuilders’ (NAHB) own “priced-out” methodology, the high profitability of U.S. homebuilders since the COVID-19 pandemic has resulted in millions of Americans being “priced out” of buying the typical new U.S. house. Since the first quarter of 2020, the range from peak to trough profits for homebuilders has resulted in as many as 4.7 million American Households being unable to afford the price of the median new house.

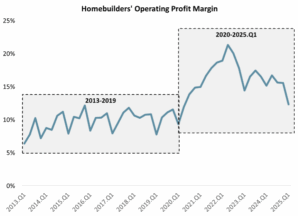

The profit margins of the largest publicly traded U.S. homebuilder companies have grown significantly since the COVID-19 pandemic. [1]

Homebuilder profits were quite stable from the post-recession recovery until COVID. From 2013 through 2019, the average operating margin was 9.8% and all quarterly margins were in a range of 6.4-12.2%. That equilibrium changed following the onset of the COVID-19 pandemic. Since 2020, the average operating margin has been 16.0%, or 6.2 percentage points higher than the average from 2013 to 2019. On a net basis, homebuilders’ net profit margins increased by 4.6 percentage points, from 7.8 percent in the pre-COVID period to 12.4 percent since COVID.

Higher profits for homebuilders mean higher house prices for potential U.S. home buyers.

The National Association of Homebuilders (NAHB) periodically publishes a report based on its “priced out” methodology.[2] The most recent report found that a $1,000 increase in the median new house price results in 115,593 U.S. households being “priced out” of being able to afford the median new house. In assessing the increase in U.S. housing prices, the NAHB “priced-out” reports typically focus on the effect of interest rates, material costs, and regulation. One factor omitted from the NAHB reports is the profitability of homebuilders. As detailed below, and based on NAHB’s own methodology, the rise in homebuilders’ profits has placed a median-priced new home out of reach for millions of U.S. households.

Since 2020, homebuilders’ quarterly net profit margins have ranged from 7.6 percent (in 2020.Q1) to 15.8 percent (in 2022.Q2).[3] By NAHB’s logic, the 8.3 percentage point increase in profitability from trough to peak would have increased the price of a new house by $41,054, and “priced out” 4,745,565 American households from being able to afford the typical home. (See Methodology and Calculations below.)

This result highlights the significant impact of homebuilder profitability on the affordability of new American homes.

Methodology and Calculations

Homebuilder profitability is assessed in terms of the range between homebuilders’ peak and trough net profit margins since 2020.Q1. The 8.3 percentage point increase from trough to peak is translated into a change in the house price where costs are held constant. Finally, the change in the house price is multiplied by NAHB’s “priced-out” result that a $1,000-increase in the house price results in 115,593 households being priced out of the median new home.[4] The table below shows the calculation. The median new house price is the same as that used in NAHB’s 2025 Priced-Out report.

Table 1: Priced-Out Calculations

| 15 Large Publicly Traded Homebuilders | Calculation | |||

| Actual price (NAHB Priced Out 2025) | $459,826 | A | ||

| Builders’ peak net profit margin | 15.8% | B | ||

| Actual profit | $72,839 | C=B*A | ||

| Implied cost | $386,987 | D=A-C | ||

| Trough net profit margin | 7.6% | E | ||

| Price consistent with trough net profit margin and actual costs | $418,772 | F=D/(1-E) | ||

| Difference between Peak profitability price and Trough profitability price | $41,054 | G=A-F | ||

| Households priced out per $1,000-increase | 115,593 | H (NAHB’s result) | ||

| # of households priced out | 4,745,565 | I =G/1000*H | ||

[1] Analysis is based on the aggregate results of 15 large publicly traded homebuilder companies: DR Horton, Lennar, Pulte Group, NVR, Taylor Morrison Home, Meritage, Toll Brothers, Century Communities, LGI HOmes, MDC Holdings, M I Homes, Beazer Homes, The Point Homes, Green Brick Partners, and Skyline Champion. According to the most recent 2022 Economic Census, the U.S. industry for New Residential Construction – New Housing For-Sales Builders (NAICS industry 236117) earned $276.6 billion of revenue in 2022 (the year of the most recent Economic Census). In 2022, these 15 public homebuilder companies earned $147.7 billion of revenue, or 53 percent of the For-Sale Builders industry in the official statistics. To the extent that this narrow industry is not perfectly aligned with the operations of the 15 public companies, note that the total new residential construction industry (NAICS 23611) had revenue of $601.4 billion in 2022. Thus, these public companies’ revenues accounted for 24.6 percent of the overall new residential construction industry in 2022.

[2] NAHB, Households Being Priced Out of the Housing Market, March 3, 2025. https://www.nahb.org/news-and-economics/housing-economics/housings-economic-impact/households-priced-out-by-higher-house-prices-and-interest-rates

[3] The homebuilders’ net profit margin reflects the weighted average net profit margins of the 15 large publicly traded homebuilders discussed above.

[4] NAHB’s result is based on the marginal effect of the house price, measured in terms of a $1,000 increase. To the extent this estimate is reliable, NAHB’s analysis indicates that it is reasonable to extend the estimated marginal effect to a larger increase in the house price, such as the $41,054 increase caused by the growth in homebuilder profitability from trough to peak. For example, NAHB’s Housing Affordability Pyramid groups U.S. households into bins based on income and house prices. The median new house prices considered above are all within the same bin, namely the 12.09 million households that can afford a house in the $400,000-$500,000 range but cannot afford a house in the $500,000-$600,000 range. By extending NAHB’s estimated marginal effect to a larger increase in prices, we assume a constant tradeoff between income and house price within this bin.